Your Amazing Guide to Renting VS Buying a House

Renting VS Buying: this debate continues to rage on between homeowners and renters. Who is actually getting the better deal? The truth is there are benefits for people in each stage of their lives with renting or buying. For some, building a family starts with buying a homestead. For others, saving money on the upfront costs is more important.

As people build careers and begin earning more money, the question becomes whether buying is affordable within the right area or whether renting would be a better option. Furthermore, if you want to invest in a property, then home ownership offers a lot of benefits.

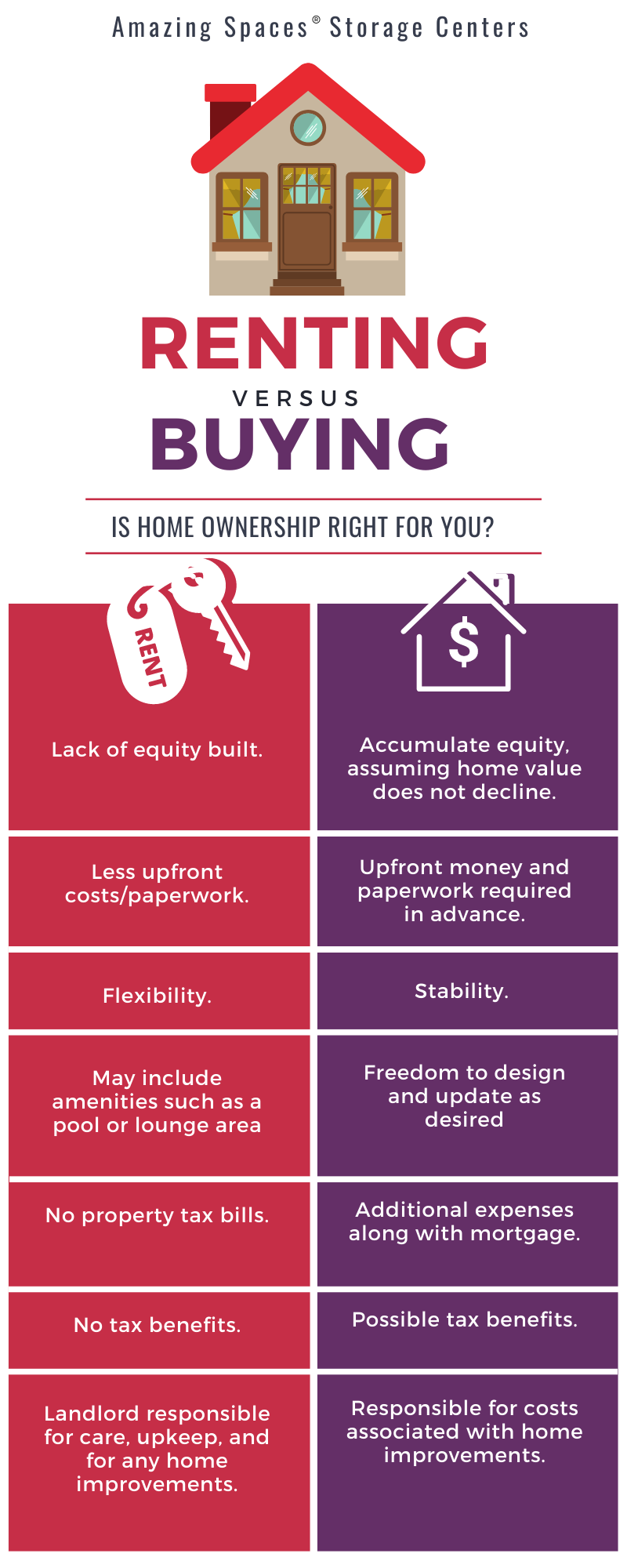

This guide breaks down renting and homeownership by different advantages, cost, tax benefits, customization, and disadvantages.

What’s the difference between renting and buying?

Let’s start off by going over the key differences between renting and buying a home. When buying a home, homeowners are able to build equity over time. As your home accumulates equity over time, the value of your home increases and you’ll be able to sell your home for a higher value when the time is right. Additionally, with a fixed-rate mortgage, rising rent is never a concern. Another factor for home buyers to consider is tax implications and will you be able to deduct the mortgage interest at tax time. Check the Changes to the tax laws in 2018 to see if you’re eligible to itemize your taxes to write off your mortgage interest payments. When it comes to maintenance costs, you’re 100% responsible to cover those as a homeowner.

When renting a home, your main responsibility is the monthly rent owed, since maintenance costs are often covered by the landlord. Depending on the rent agreement, you either pay for utilities on your own or they’re included in your rent owed each month. Renting has a lot of advantages like allowing you more flexibility and less over-head or unexpected costs, however, there are also a few disadvantages when it comes to long-term goals like not being able to build equity.

When deciding to rent or purchase, consider your current phase of life and where you see yourself in 5 years, etc. This will allow you to make the best financial decision as you weigh your options.

Determine what can you afford. Something else to take into account when making this decision is how much you can afford.

Costs of Renting a Home

In general, there are lower costs and easier entry fees for renting a home or apartment. Here are some costs you can expect:

- Security deposit— Most rentals will require a security deposit to cover any damages that may occur during the rental or a broken lease. If you have good credit, you may be able to avoid this deposit fee, but usually, you will be required to pay up to 1.5 times the rental price to secure the rental.

- Pet Deposit – Do you have any cats or dogs? Your landlord may require a pet deposit to cover any repairs necessary. Some landlords may require a monthly fee in addition to the deposit.

- Application Fees – To run a credit and background check, the landlord may ask you to pay a non-refundable fee of $40 to $100 per applicant.

- Utilities—An important question to bring up to your landlord is whether or not your monthly rent includes utilities, such as water, electric, gas, cable or internet.

- First and Last Month’s Rent – In some cases, landlords will require both first and last month before the move-in date. This can get pretty costly if you are renting a large home with extra features like a pool or family game room in a nice neighborhood.

- Monthly rent in your area—Consider the average cost of rent in the area to determine your best financial decision. Often times metropolitan areas will surge the cost of rent making home ownership a more attainable goal.

Costs of Buying a Home

There are a few things that you should know before buying a home. For one, there are a number of upfront and closing costs.

- Money down—You must pay a percentage of the purchase price upfront as a down payment. For homebuyers, if you put less than 20% down your lender will typically require you to purchase private mortgage insurance, or PMI, which drives up your monthly payments.

- Closing costs—These are the fees you pay when obtaining your loan. Average closing costs for the buyer run between about 2% and 5% of the loan amount.

- Equity rate—Consider home equity rates and be sure to shop around for the lowest rate.

- Home Appraisal – Buyers take care of the home appraisal costs. These range from $300 to $500. This is necessary to get the loan approved by the mortgage company.

- Home Inspection – While you do not have to get a home inspection, it is recommended in order to spot issues with the home like mold, water damage, foundation problems, pipe cracks, and other major issues that can lead to remodeling costs.

- Property Taxes – Property taxes are a new problem you’ll have to worry about when you buy a home. Texas has the 5th highest property tax rate in the nation. Try to include property taxes in your monthly mortgage payment to avoid coming up with a large lump sum every year.

- Homeowners Insurance – Lenders also require that you provide proof of homeowner’s insurance prior to the closing date. You typically will have to pay the first year’s premium upfront. This is based on the style, location, value, and contents of the home.

- Monthly Loan Payment – Just like with a rental payment, you have a monthly mortgage payment that you must pay on time or else you will have to deal with higher interest rates and loan collection calls.

- Maintenance – Lawn, home, upkeep, repairs, and other remodeling costs are all the responsibility of the homeowner once you purchase a home. If you are part of an HOA, you will have to pay hundreds of dollars in fees per month, depending on the area.

Advantages and Disadvantages of Buying and Renting

Equity Over Time: With home buying, you invest in your home and build equity. Every dollar that you put toward your loan payment, you add to the equity percentage, and once you reach a 20% or 80% loan to value ratio, you can refinance if you want to.

Tax Benefits: Homeowners also get some credits back for purchasing a home. Many states have exemptions for owner-occupied homes. There are also federal tax reductions for first-time home buyers.

Potential Income: Homeowners can often move out of their first home and put it up for rent, turning the property into an investment property and income-generating investment.

No Maintenance Costs for Renters: Your landlord has to take care of the lawn and repairs with a rental. You simply have to make a phone call to get something fixed. This is covered in landlord-tenant laws.

Renters Have Lower Credit Requirements: Most landlords do not have a specific minimum for credit scores. If you can prove income and rental history, then you’re in. Unless a score is specified, it’s likely that you can prove income with pay stubs to lock in a rental.

No Creative Control or Modification with Rentals: You’re not really allowed to re-paint, remodel, add new appliances, or replace the flooring with a rental. Your landlord will get extremely upset if you paint the walls in their home lime green, especially if they have already had a specific palette. Most landlords will state what you can and cannot modify within the apartment.

Renting VS Buying – The Final Verdict

The right time to purchase a home depends on your financial situation. If you have the upfront costs and financial means to jump into homeownership, then you can avoid issues with rental payments being tossed away without contributing to an investment. Depending on where you choose to live, you may also want to look at mortgage rates and property taxes to see how much homeownership will cost compared to the average rental home.

To more accurately calculate the opportunity costs of each option as well as weigh out your current life situation determinants, use the New York Times Rent vs. Buy calculator. We hope your experience, whether it’s renting or purchasing, is truly amazing

Daisy James

I like how you said that there are fewer costs when you rent. My sister was at my house last night for dinner, and she talked about how she and her fiance want to move into a home together in the summer, but they are worried about being able to afford it. I’ll pass this information along to her so they can look into moving into a house rental. https://www.davidmcdonaldrentals.com/tenant-portal

Edmund Porter

Great post on renting vs buying a house and lot! I appreciate the clear breakdown of the pros and cons of each option. As a renter myself, I definitely relate to the appeal of flexibility and lower upfront costs. However, I’m also starting to think about the long-term benefits of homeownership, like building equity and having a place to personalize. It’s a tough decision, but your article has given me a lot to think about. Thanks!

Nik

Thank you for sharing the informative article.